Banking Giants Thrive Amidst Market Surge

In a bustling third quarter, major Wall Street banks like JPMorgan Chase and Goldman Sachs saw significant profit increases, driven by a surge in investment banking and trading activities.

JPMorgan’s Impressive Performance

JPMorgan reported a net income of $14.4 billion, marking a 12% rise compared to the same period last year, surpassing analyst expectations by approximately $1 billion.

The bank’s investment banking revenue soared by 17% to $2.6 billion, while trading revenues experienced a 25% boost, reaching $8.94 billion.

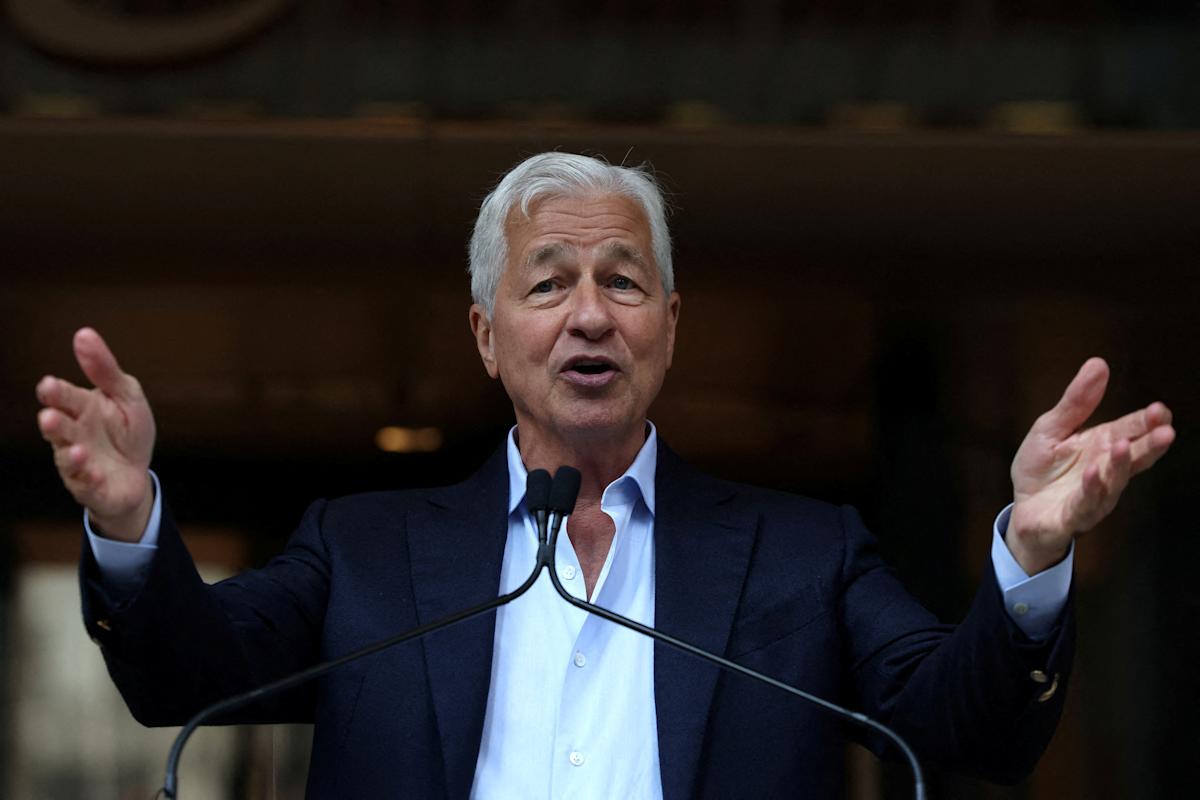

CEO Jamie Dimon highlighted the U.S. economy’s resilience, noting a favorable environment for mergers and acquisitions.

Dimon also cautioned about ongoing risks such as trade tensions, geopolitical instability, and high asset prices, emphasizing the need for preparedness.

Goldman Sachs’ Strong Quarter

Goldman Sachs reported a net income of $4.1 billion, a 37% increase from the previous year, exceeding forecasts by about $500 million.

Their investment banking revenue jumped 42% to $2.6 billion, with trading and financing revenues rising 11.5% to $7.2 billion.

CEO David Solomon attributed the results to a robust client base and strategic focus in a favorable market climate.

Wells Fargo’s Steady Growth

Wells Fargo’s third-quarter profits reached $5.6 billion, a 9% increase from the previous year, also surpassing analyst predictions by about $500 million.

Their investment banking fees rose 25% to $840 million, bolstered by their role in Union Pacific’s $72 billion acquisition of Norfolk Southern Corp.

CEO Charles Scharf noted the bank’s momentum and the strong financial health of clients despite some economic uncertainties.

Market Reactions and Future Outlook

JPMorgan’s stock remained stable, Wells Fargo saw a 2% increase, while Goldman experienced a decline. The results set the stage for a promising earnings season for the banking sector.